Best Long-Term Investment

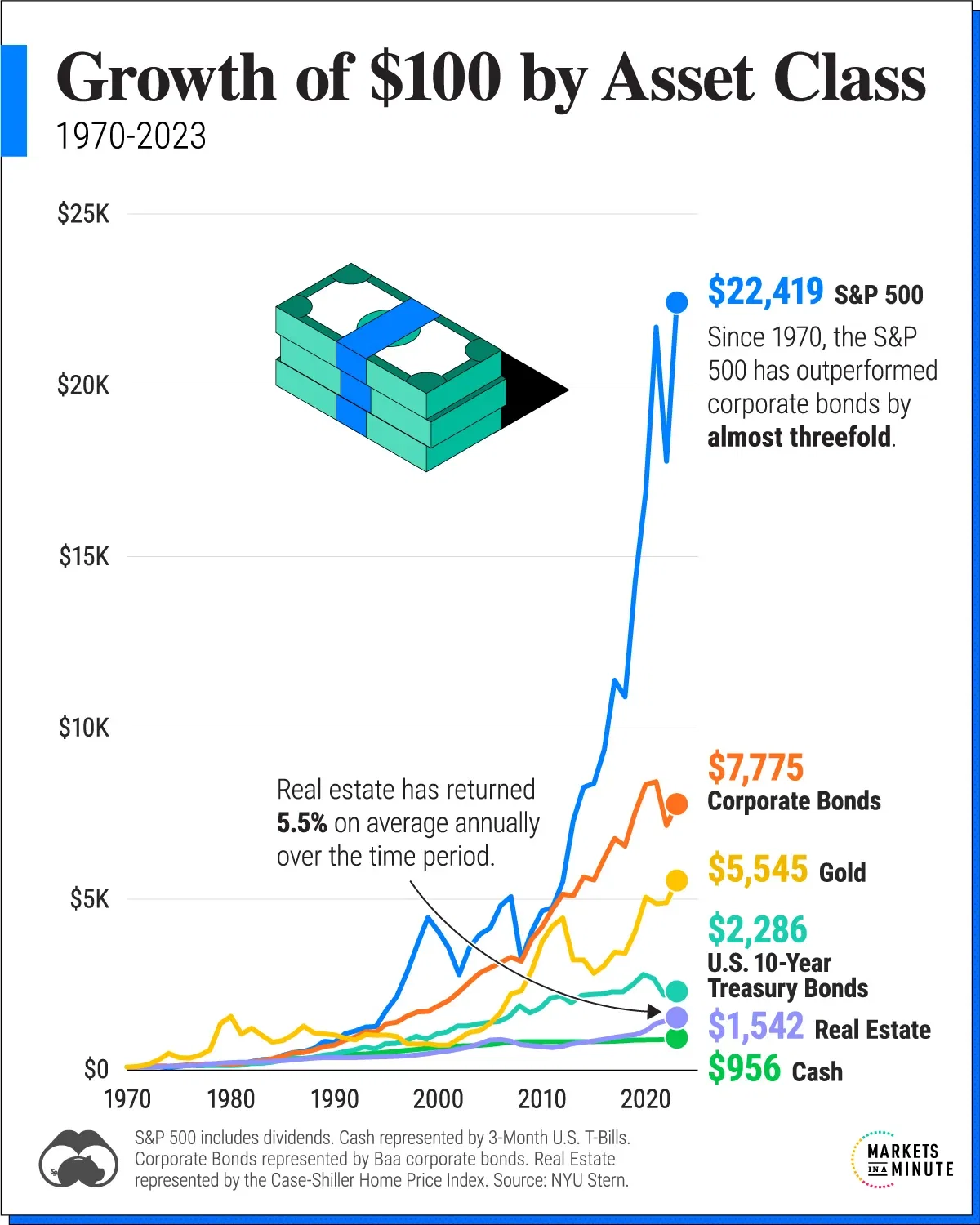

The stock market has historically been the most profitable investment over the long term

A Tool for Global Diversification

Investing in the stock market enables you to diversify your portfolio across:

-

-

-

-

-

Geographic regions: U.S., Europe, Asia (China, etc.)

-

Sectors: Technology, healthcare, environment, telecommunications, and more

-

Asset types: Individual stocks, broad market indexes, bonds, commodities, etc.

-

-

-

-

Liquidity & Flexibility

Stocks are highly liquid assets. You can buy or sell them at any time during market hours, and access your funds quickly whenever needed.

You can do more than simply track the index.

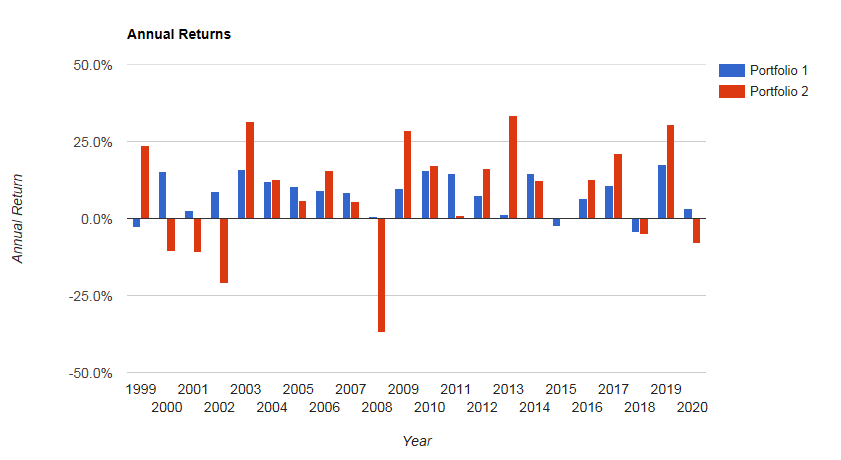

It’s possible to reduce risk and volatility during market downturns.

Even in periods of stock market crashes, some portfolios managed to remain slightly positive, while others demonstrated remarkable resilience.

annual returns of two portfolios between 1999 and march 2020

Portfolio 1 is a diversified portfolio

Portfolio 2 is only composed of US stocks

During the crises of 2000 and 2008 :

Portfolio 1 which is well diversified, was up 8% and 0,75%

Portfolio 2 100% stocks composed, at the same time lost 20% and 37%,

.

Diversified portfolios with good allocation, helps managing risk and reducing volatility because they are composed of non correlated assets

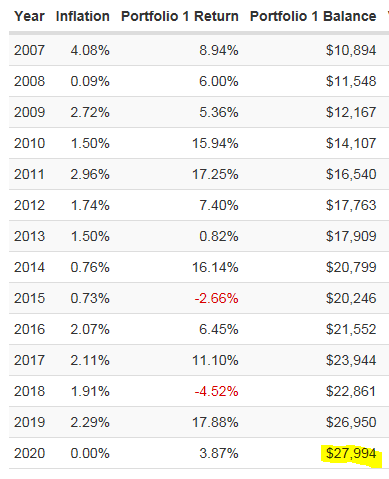

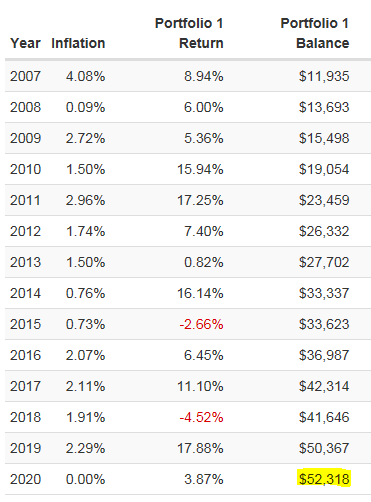

PERFORMANCE OF A 10-YEARS DIVERSIFIED PORTFOLIO (BETWEEN 2007 AND march 2020)

10,000$ invested in 2007, in march 2020 worth is 27994$

Now, same portfolio but this time you saved 1000$ every year that you had reinvested in this portfolio, will be 52318$ in march 2020