60/40 portfolio

Stocks / Indices

60%

Bonds

40%

MOST SIMPLE COMPOSITION WITH VERY GOOD PERFORMANCE, BUT ALSO MORE RISKY, BECAUSE LESS DIVERSIFIED

It can suffer high volatilities and an important Drawdown in some years, even if they are strongly attenuated compared to stock only,

Need ability to support these periods psychologically and financially

Big drop during the subprime for example, big performance after but it took a while.

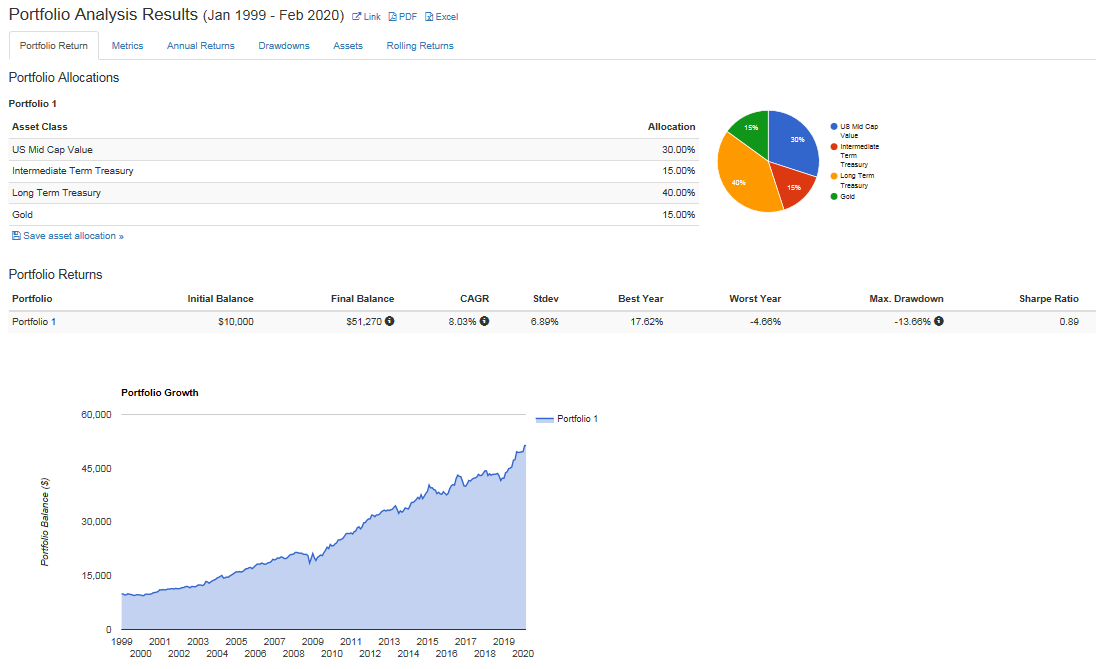

All weather portfolio

Stocks / Indices

30%

Long Term State Bonds

40%

State Bonds Intermediate Term

15%

15% Gold (or 7.5% in Gold and 7.5% in commodities)

15%

Permanent portfolio

Stocks / Indices

25%

State bonds

25%

Precious metals

25%

Cash

25%