OPTIONS ARE the MOST powerful financial instrument

Options are financial contracts that grant the buyer the right, but not the obligation, to purchase or sell an underlying asset at a predetermined price—known as the strike price—on or before a specified date.

To fully understand how options work, it is essential to become familiar with the key terms associated with these contracts.

Strike Price: This is the agreed-upon price at which the buyer of the option can buy or sell the underlying asset.

Value Time: The time value of an option is the premium paid by the buyer to the seller for the option to buy or sell the underlying asset.

Volatility: The volatility of the underlying asset is a measure of the potential price movements of the asset. This volatility affects the price of options.

Premiums: The buyer of an option pays a premium to the seller for the right to exercise the option. This premium is the price of the option.

There are several widely used options strategies that traders employ to manage risk and generate income. Each strategy comes with its own set of advantages and risks. Notably, some strategies allow you to profit even when the market remains flat or shows little movement, such as the iron condor and iron butterfly, which are specifically designed to benefit from periods of low volatility.

Understanding and selecting the right strategy depends on your market outlook and risk tolerance

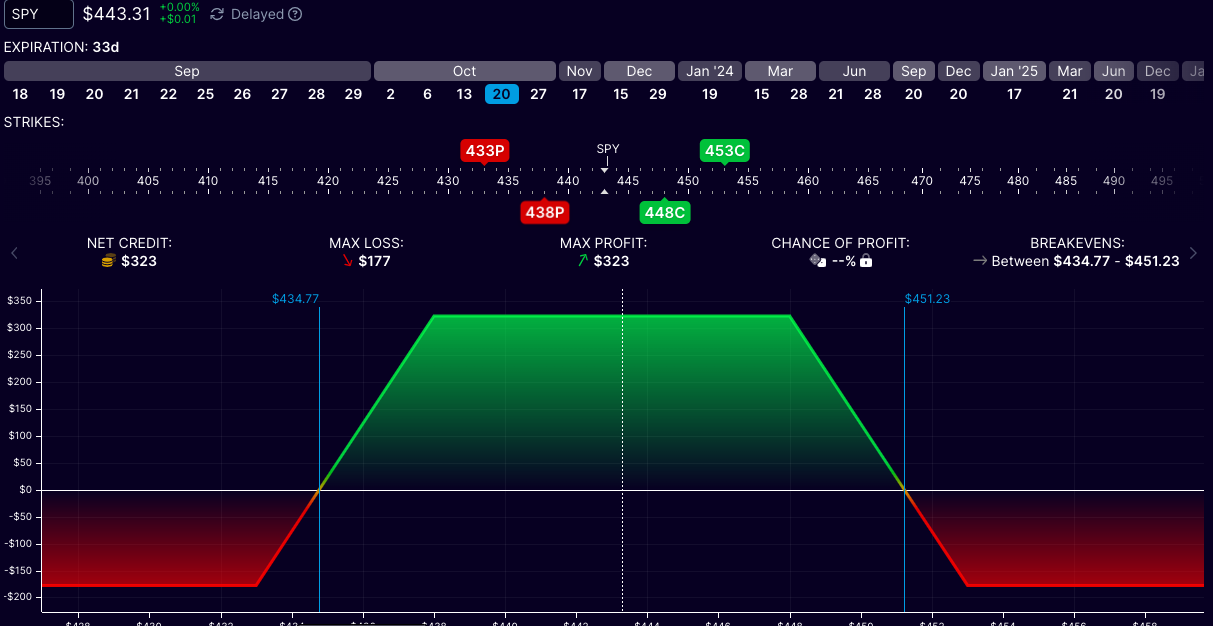

Iron Condor

This strategy involves selling a call spread and a put spread on the same underlying asset.

The trade profits if the price of the underlying asset stays within a certain range.

However, if the price moves outside of this range, the trader can experience losses.

Credit Spread

This strategy involves selling a call or put option at a higher strike price and buying a call or put option at a lower strike price.

The trader receives a credit for this trade, which can be used to offset potential losses.

However, if the price of the underlying asset moves against the trader, losses can occur.

SHORT Strangle

This strategy involves selling both a call and put option on the same underlying asset, with different strike prices.

The goal is to profit if the asset price doesn’t move substantially, and stay in the range between the put and the call

There are countless possible combinations and strategies in options trading, each offering different levels of risk and reward.

One of the main advantages is that you can define your risk and set maximum loss limits in advance, allowing for greater control over your exposure

These strategies can be used both to protect your portfolio—through hedging techniques like protective puts—and to generate income by collecting premiums, such as with covered calls or spreads

This flexibility makes options a powerful tool for managing risk and pursuing various investment objectives.

Covered CALL

A covered call can generate income from a stock position without risk, because you protect the short call with your stocks

1- Own stock (100 shares for a total security)

2- Sell CALL contract (1 contract = 100 shares)

Selling naked PUT

You can sell naked put if you think the stock price is going to go up or stay above the strike,

use this on stocks you want to buy anyway, maybe you ll have these for less in case the price drop at the strike or below

You have to take into account that the risk in this strategy is if the stock drop, you can lose (X contract x 100 x the strike)

Monitoring the VIX (Volatility Index) is crucial for timing when to sell call or put options.

Selling options when the VIX is high—typically above 20%—can lead to better returns because option premiums tend to be higher during periods of elevated volatility.

However, it’s also important to check the implied volatility of the specific option you’re trading, as this directly affects the premium you can collect and the potential risk involved.